OVERVIEW OF LAND LEASING

Du Long Industrial Park is currently active and thriving. With a vision to develop into a green industrial zone, Du Long Industrial Park is an ideal destination for investors who prioritize sustainable development.

The industrial park boasts a strategic location, synchronized technical infrastructure, attractive investment incentive policies, and streamlined investment procedures.

Standard infrastructure

MASTER PLAN OF DU LONG INDUSTRIAL PARK

Actual images

WHY CHOOSE DU LONG INDUSTRIAL LAND FOR LEASE

Strategic location, Execellent Transportation Connectivity

Du Long Industrial Park boasts a strategic location by directly connecting to National Highway 1A at the entrance gate of the IP.

The IP enjoys convenient connectivity to a diverse transportation infrastructure network, including road, sea, air, and railway.

The transportation infrastructure system is continually expanding, providing high economic efficiency for investors.

Advanced Infrastructure System

Du Long Industrial park is committed to investing in advanced technical infrastructure to ensure investor’s confidence in its manufacturing operations. The wastewater treatment capacity reaches up to 12,000m2/day-night, featuring a back-up reservoir, dedicated commercial service area, and housing for experts and workers.

Land Lease Incentives

Attractive investment incentives include:

- Corporate income tax incentives

- Land lease/ land tax exemption throughout the project's investment period (according to Decree 142/2005/NĐ-CP)

- Import tax exemption for machinery and equipment used to create fixed assets (according to Decree 149/2005/NĐ-CP)

- Support & consultation for investment submission procedures

ACCEPTED INVESTMENT FIELDS

OUR CLIENTS

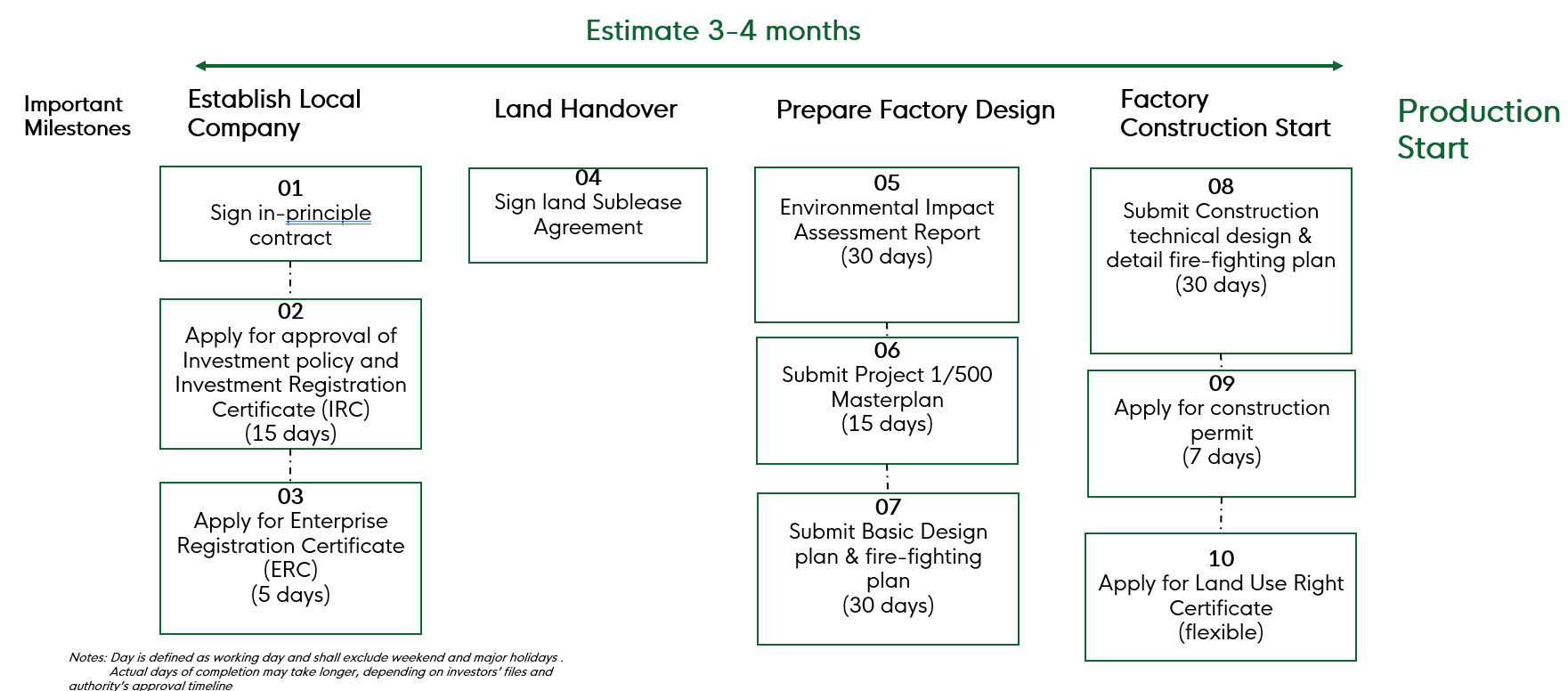

STANDARD INVESTMENT PROCEDURE

Frequently Asked Questions

Construction Density/ Height Requirement?

Construction density: ≤ 70%. Construction density depends on factory’s height and the land area as specified according to the table below QCXDVN 01:2008/BXD regarding Vietnamese standards on construction planning:

| Factory’s height (m) | Maximum construction density (%) according to the area of the land | ||

|---|---|---|---|

| ≤ 5.000m2 | 10.000m2 | ≥ 20.000m2 | |

| ≤10 | 70 | 70 | 60 |

| 13 | 70 | 65 | 55 |

| 16 | 70 | 60 | 52 |

| 19 | 70 | 56 | 48 |

| 22 | 70 | 52 | 45 |

| 25 | 70 | 49 | 43 |

| 28 | 70 | 47 | 41 |

| 31 | 70 | 45 | 39 |

| 34 | 70 | 43 | 37 |

| 37 | 70 | 41 | 36 |

| 40 | 70 | 40 | 35 |

| >40 | 70 | 40 | 35 |

What is the minimum land lease in Du Long IP and what is the land lease period?

Minimum: 10,000m2

Until 2057

Site connection of the IP?

Distance to cities, seaports, airport, railway and expressway:

- Major Cities: HCMC: 350 km, Nha Trang: 70 km, Dalat: 110 km

- Sea Ports: Cam Ranh seaport: 25 km, Ca Na seaport: 45 km, Vinh Tan seaport: 50 km

- Airport: Cam Ranh international airport: 40 km

- North South railway – Phan Rang station: 20 km

- North South Expressway – Cam Lam Vinh Hao connection point: 6 km

Are there amenities and retail services within the IP?

- Amenities in Du Long IP:

+ Eletricity:110/22KV

+ Water Supply:15.000 m3/day-night capacity

+ Drainage and Waste Water Treatment: 12.000m3/day-night capacity

+ Total land area ready to lease: 140 ha

- Retail service: available inside the IP on area of 5 ha (banks, restaurants, accomodation area for workers and experts…)

How are the tax incentives?

Accoring to IRC dated 27/04/2007 and 3rd revision dated 07/11/2022, Decree No.46/2014/NĐ-CP and Decree No. 35/2017/NĐ-CP, the tax incentives are as follows:

- Free land tax

- Corporate Income Tax Reduction: 10% in 15 years:

- 0% for 1st 4 years since taxable income

- 50% for the next 9 years

- Import tax exemption

Does Du Long Industrial Park have an environmental license? What are the favorable industries?

Du Long IP is granted Environmental License No. GPMT306/GPMT-BTNMT. The favorable industries are:

- Food manufacturing and processing

- Beverage manufacturing

- Textile, weaving and dyeing

- Apparel & garment manufacturing

- Leather and related products manufacturing

- Wood processing and production of bamboo products

- Paper and paper products manufacturing

- Chemical products manufacturing

- Pharmaceutical products manufacturing

- Plastics and rubber manufacturing

- Metal manufacturing

- Prefabricated metal products manufacturing

- Electronic products, computers and optical products manufacturing

- Electrical equipment manufacturing

- General Automobile manufacturing

- Furnitures manufacturing

- General Manufacturing and processing

- Manufacturing and distribution of electricity, gas, hot water, steam and air conditioning

- Supply of water, drainage, and wastewater

- Warehouse and logistics

Can Land Use Right Certificate be issued to tenants?

As prescribed by Vietnam Land Law 2013, the Lessee will be issued Land Use Right Certificate after 100% of rental fee is fully paid.

How many Ips in Ninh Thuan province?

There are 4 Ips in Ninh Thuan province:

- Du Long IP

- Thanh Hai IP

- Phuoc Nam IP

- Ca Na IP

What are the investment procedures until operation?

What is the minimum wage for workers in the province? How is overtime calculated?

- Minimum wage for Ninh Thuan province is region 3: 3.640.000 VNĐ/month.

- Per Clause 98 of Vietnam Labor Code 2019, overtime is calculated as belows:

- On normal day: 150%

- On weekend: 200%

- On public holidays: 300%

What are the import tax incentives on equipments and machinary?

Per Decree 87/2010/ND-CP dated 13/08/2010 regarding the Law on Import and Export Tax, investors are exempt from import tax on goods to create fixed assets.

For used machinery and equipments, the conditions for importing machinery and equipment must apply according to Decision No. 18/2019/QD-TTg (machines’ age must not exceed 10 years or remaining performance of the machines still reaches 85% of the original design efficiency)